Understanding Japanese Search Engines 2023: Popularity, Share, and Trends

Ever wondered which search engine reigns supreme in Japan?

While it’s true that Google dominates the search engine landscape globally, the story in Japan has its unique twists. Yes, Google Japan holds a strong position, but what about Yahoo! JAPAN, Bing, Infoseek, and goo?

In the diverse world of Japanese search engines, user share can vary significantly. Factors such as the device used for searching – be it a desktop computer or a mobile device – can also influence the popularity of different search engines.

In this article, we delve into the intricacies of the Japanese search engine landscape. We’ll explore the latest statistics from reliable sources, providing a comprehensive view of search engine usage in Japan. So, let’s embark on this journey to uncover the secrets of search engine popularity in the Land of the Rising Sun.

- Japanese search engine share by the device

- Navigating the Yahoo! Landscape in the Japanese Search Engine Market: Is it worth the SEO effort?

- Bing’s Potential in the Japanese Search Engine Market: Is It Worth the Investment?

- Actual Search Engine Share Across Different Japanese Websites: A Comparative Study

- Do Search Volumes Vary Across Different Search Engines in Japan?

- Why Does Yahoo! JAPAN Maintain a Relatively Higher Search Engine Share Than in the Rest of the World?

- Choosing the Right Japanese Search Engine for Your Needs

Japanese search engine share by the device

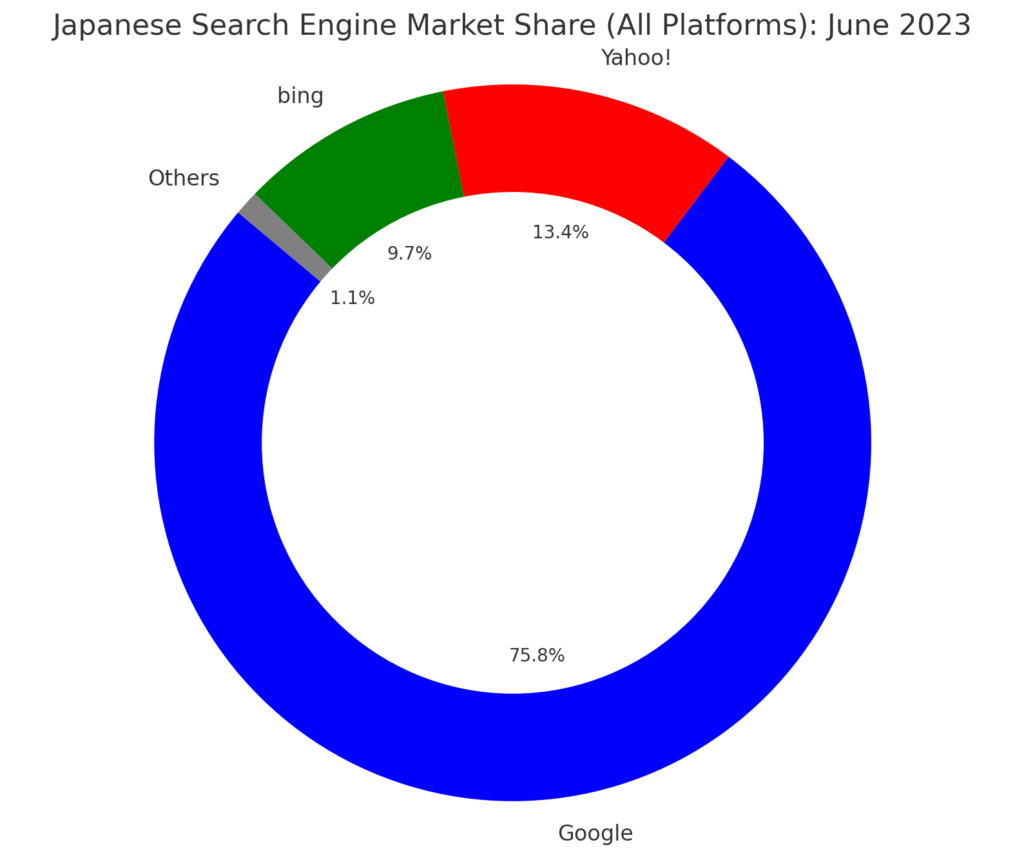

Japanese search engine share: All Devices

- Google: 75.8%

- Yahoo!: 13.4%

- Bing: 9.7%

The pie chart above shows the Japanese search engine market share across all platforms (desktop, mobile, and tablet) for June 2023. Each slice represents a different search engine: Google (blue), Yahoo! (red), Bing (green), and the aggregated Others (grey).

Google had the largest market share in June 2023, followed by Yahoo!, Others, and Bing.

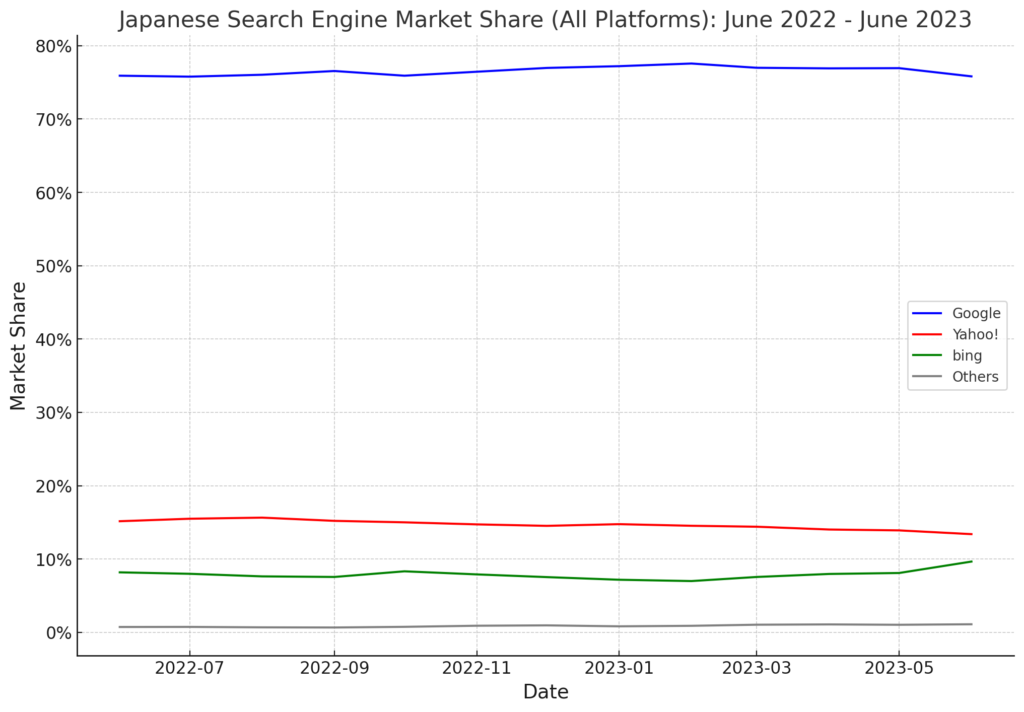

Japanese search engine share trend: All Devices

The line chart above shows the trend of the Japanese search engine market share across all platforms (desktop, mobile, and tablet) from June 2022 to June 2023. Each line represents a different search engine: Google (blue), Yahoo! (red), Bing (green), and Others (grey).

As you can see, Google consistently holds the largest market share throughout the year, while Bing shows a notable increase over the year.

Now, let’s discuss some key takeaways and interesting findings from this data:

- Google’s Dominance Across Platforms: Google maintains a strong lead across all platforms in the Japanese search engine market. This consistent dominance from June 2022 to June 2023 underlines Google’s significant influence and strong user preference in Japan.

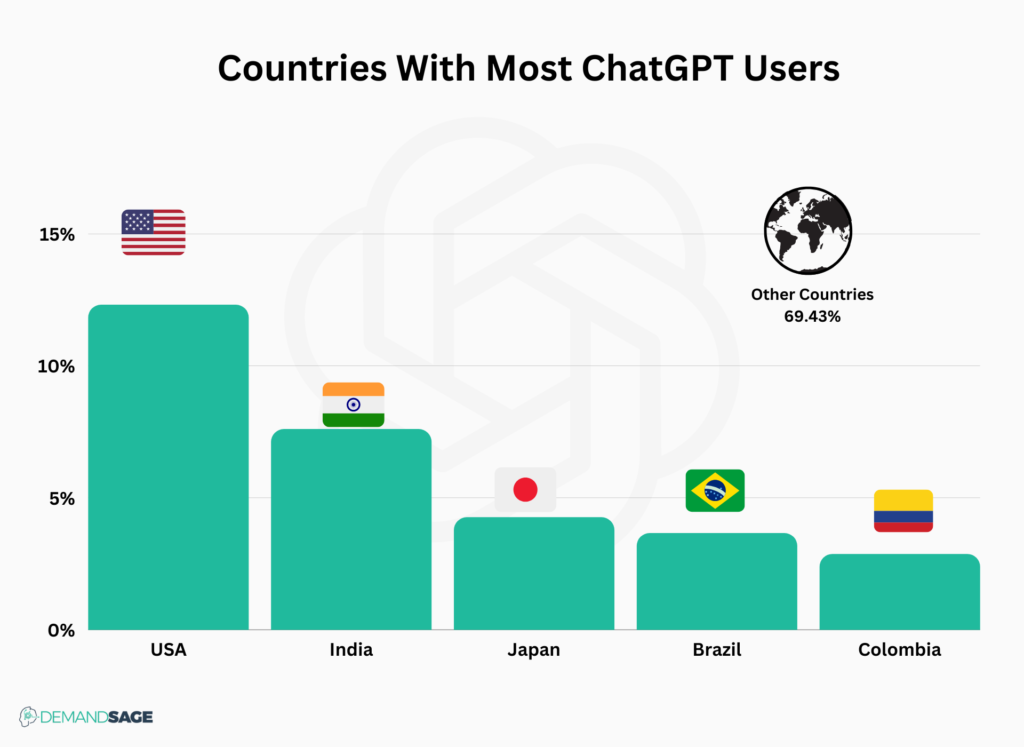

- Bing’s Growth Across Platforms: Bing’s market share across all platforms shows a notable increase over the year. This growth might be linked to the release of Chat-GPT, developed by OpenAI and utilized by Microsoft, Bing’s parent company. As AI technologies like Chat-GPT become more sophisticated, they can influence the usage of associated platforms, such as Bing, in the Japanese market.

- Steady Performance of Yahoo! and Others: Yahoo!, a long-standing player in the Japanese search engine market, maintains a stable market share throughout the year. Other search engines, though collectively smaller than Google, Bing, and Yahoo!, also maintain a steady market share, indicating a diverse landscape of the Japanese search engine market.

- Shifts in Market Share: Despite Bing’s growth, Google’s market share remains significantly higher. However, the combined market share of Bing and Yahoo! is approaching closer to Google’s, highlighting the evolving competitive landscape of the Japanese search engine market.

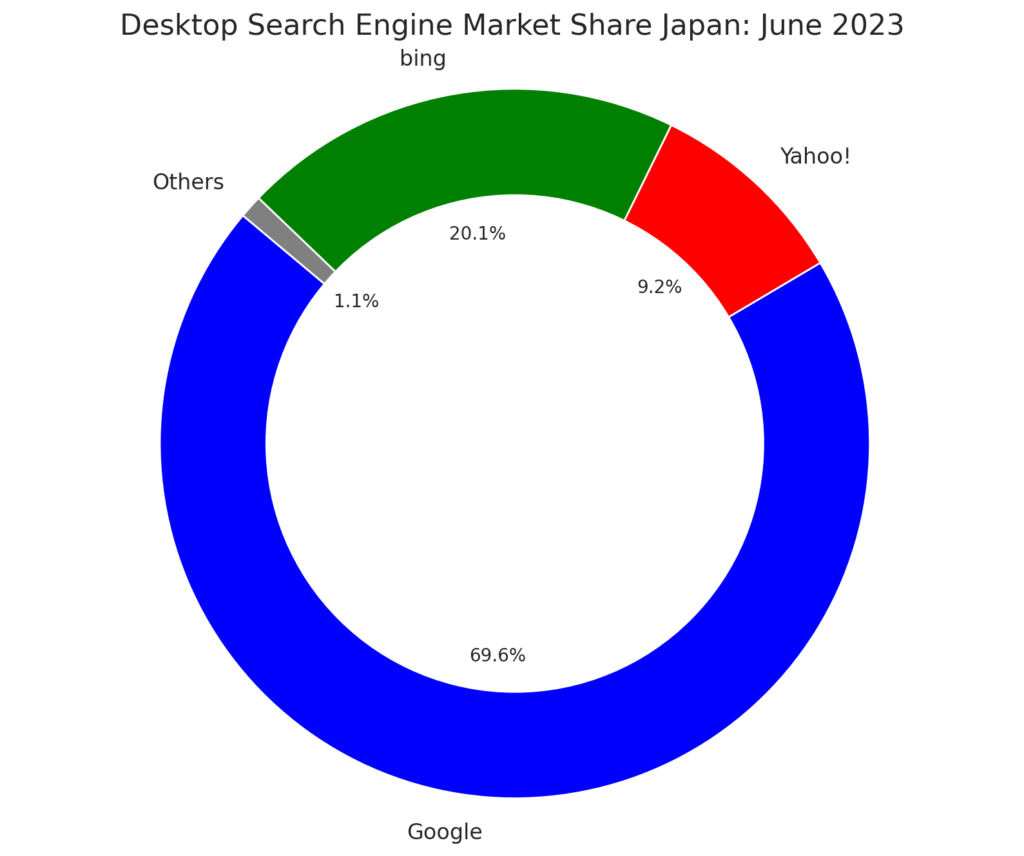

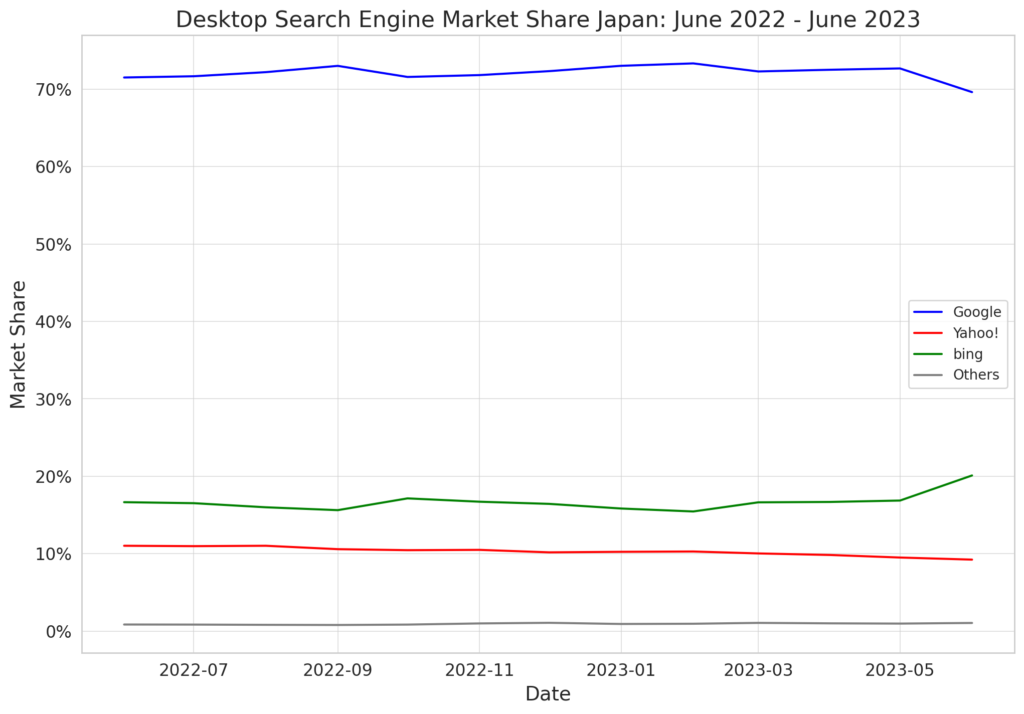

Japanese search engine share: PC

- Google: 69.6%

- Yahoo!: 9.2%

- Bing: 20.1%

Japanese Search Engine Share Trend: PC

- Google’s Dominance in Japan: Google consistently holds the highest market share among all Japanese search engines on desktop from June 2022 to June 2023. This shows Google’s significant dominance in the Japanese desktop search engine market.

- Bing’s Rise in Japan: Bing, another major player in the Japanese search engine market, has shown a notable increase in its market share over the year. This growth could be connected to the release of Chat-GPT, developed by OpenAI and utilized by Microsoft, Bing’s parent company. As AI technologies like Chat-GPT become more advanced, they can influence the use of associated platforms, such as Bing, in Japan.

- Steady Performance of Yahoo! and Others: Yahoo!, a long-standing player in the Japanese search engine market, maintained a relatively stable market share throughout the year. Other search engines, though collectively less than Google, Bing, and Yahoo!, also displayed a stable market share, showcasing the diversity of the Japanese search engine landscape.

- Competitive Landscape: Although Bing’s growth is noteworthy, Google’s market share remains significantly higher. Interestingly, the combined market share of Bing and Yahoo! is comparable to Google’s, hinting at a competitive landscape in the Japanese search engine market where Google faces a collective competition from multiple players.

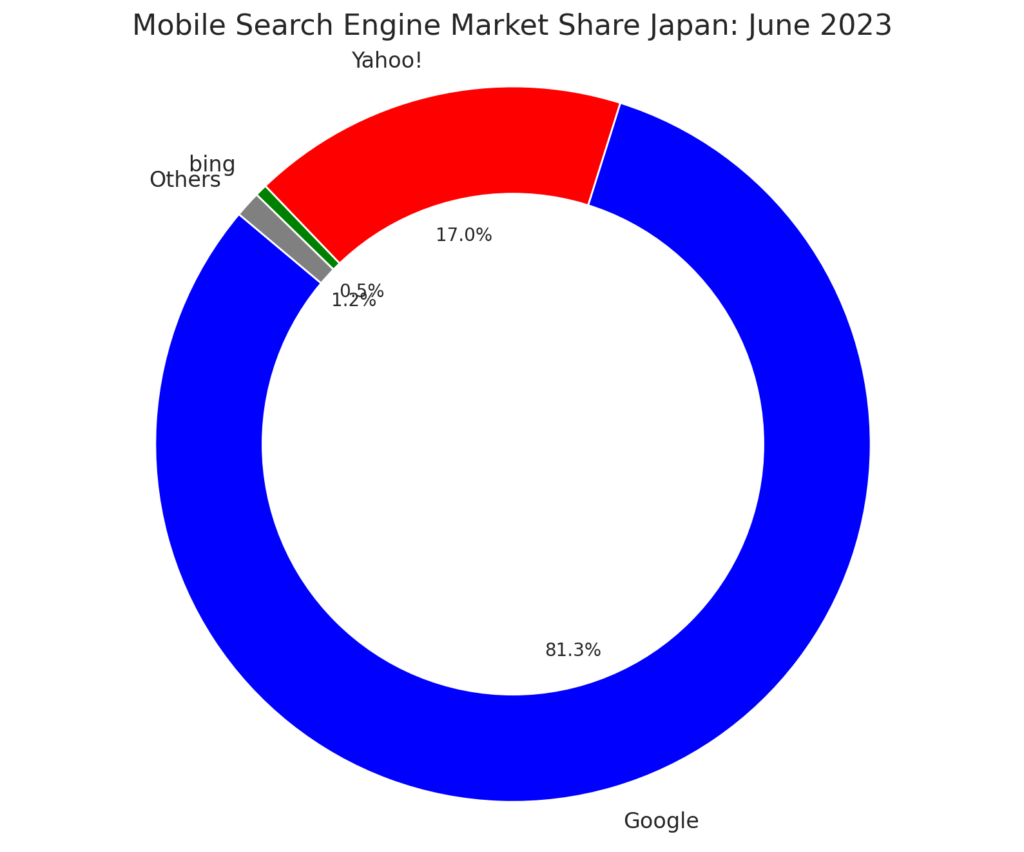

Japanese Search Engine Share: Mobile

- Google: 81.3%

- Yahoo !: 17.0%

- Bing: 0.5%

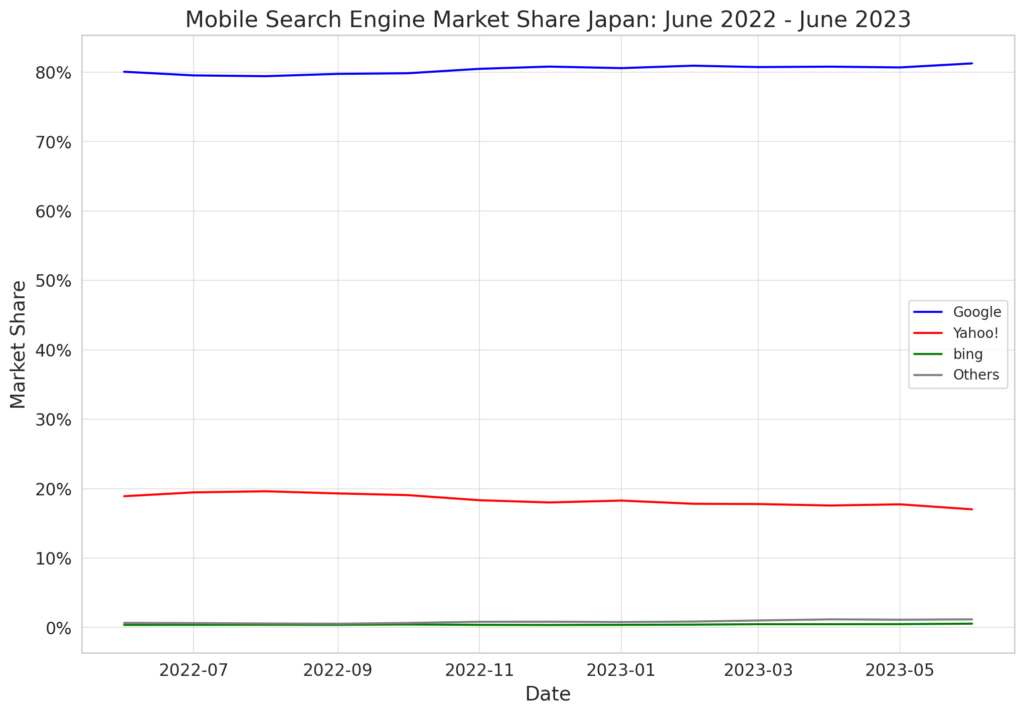

Japanese Search Engine Share Trend: Mobile

Data source: statcounter

- Google’s Superior Position in Mobile: In the Japanese search engine market on mobile, Google’s dominance is even more pronounced. This could be due to the widespread use of Android devices (which have Google as the default search engine) in Japan, and Google’s effective performance on mobile-specific factors such as local search, voice search, and loading speed.

- Bing’s Smaller Mobile Presence: Bing holds a significantly smaller market share on mobile compared to desktop in Japan. This could be due to factors like fewer mobile devices using Bing as the default search engine, or Bing’s mobile optimization strategies being less effective in the Japanese market.

- Consistent Performance of Yahoo!: Yahoo! consistently holds the second place in the mobile Japanese search engine market, indicating a stable user base who prefer Yahoo! on their mobile devices.

- Other Players: The remaining search engines each make up a small portion of the Japanese mobile search engine market, showing that this market is heavily dominated by Google and Yahoo!.

When we compare the mobile and desktop data, we see some interesting differences in the Japanese search engine market:

- Google’s market share is higher on mobile than on desktop. This could be due to factors such as the prevalence of Android devices in Japan and Google’s strong mobile optimization.

- On the other hand, Bing’s market share is lower on mobile than on desktop, which could be due to fewer devices using Bing as the default search engine or less effective mobile optimization in the Japanese context.

- Yahoo!’s market share remains relatively stable across both platforms, indicating a consistent user base across devices in Japan.

These observations offer a glimpse into the dynamics of the Japanese search engine market across different devices. The release of Chat-GPT may influence these trends, especially for Bing, considering its integration with Microsoft’s ecosystem. As always, these trends are likely influenced by a combination of many factors, and would require further in-depth analysis for a comprehensive understanding.

Navigating the Yahoo! Landscape in the Japanese Search Engine Market: Is it worth the SEO effort?

Yahoo! has long been a household name in Japan’s web services industry. Despite Google’s overwhelming share in the Japanese search engine market, Yahoo! continues to command a substantial user base.

Interestingly, Yahoo! utilizes the same search engine system as Google. This essentially means that the fundamental mechanics of Yahoo! are identical to Google’s. While Yahoo! previously incorporated its unique system, it adopted Google’s search engine and its search ad delivery system in 2011. While there may be minor variations in the search result rankings (which we’ll touch upon later), it’s crucial to understand that Yahoo!’s search engine is virtually the same as Google’s.

Given this, can we assume that SEO strategies for Google would suffice for Yahoo!? The answer is largely ‘Yes.’ Since Yahoo! provides its search engine services using Google’s system, implementing SEO strategies for Google effectively covers Yahoo! as well. This eliminates the need for learning Yahoo!-specific SEO strategies; the points to be aware of are essentially the same for both Google and Yahoo!. If you search using the same keywords, the search results will appear in almost the same order.

Therefore, even if you want to improve your site for users searching on Yahoo!, strategies aimed at users searching on Google will suffice. This is because modern SEO, whether on Google or Yahoo!, prioritizes a ‘user-first’ approach. Regardless of the type of search engine, by improving the quality of your content, you can aim for a higher display in search results.

However, it’s worth noting that while the organic SEO practices are the same, the ad platforms differ. If you plan to run ads, you will need to use both Google Ads and Yahoo! Ads platforms. This is an important consideration when budgeting your resources for maximum impact in the Japanese search engine market.

In conclusion, while the SEO practices for Google largely cover Yahoo!, the distinct nature of their ad platforms is a factor that should not be overlooked in your digital marketing strategy for the Japanese search engine market.

Bing’s Potential in the Japanese Search Engine Market: Is It Worth the Investment?

In the realm of Japanese search engines, the prominence of Google and Yahoo! has often overshadowed other contenders like Bing. However, recent advancements in AI technologies, such as the release of Chat-GPT by OpenAI and Microsoft, have sparked a noteworthy growth in Bing’s market share.

Despite this growth, it’s essential to contextualize Bing’s performance: Google still significantly outperforms Bing, holding a commanding lead in the Japanese search engine market across all platforms. This gap is particularly evident in the mobile sector, where Google’s dominance is even more pronounced due to factors such as the widespread use of Android devices and Google’s strong mobile optimization.

For businesses operating on a limited budget, this landscape suggests that investment in Google might yield a higher return, given its larger user base. However, the recent trends in Bing’s growth underscore its potential and the influence of AI technologies on the search engine landscape.

Moreover, the combined share of Internet Explorer and Microsoft Edge, both popular browsers in Japanese corporations and defaulting to Bing for search, comes close to that of Google Chrome. Given the prevalence of Windows-based PCs in Japan, Bing maintains a significant presence, particularly in the desktop sector.

While Bing’s share may not be substantial at the moment, its recent growth indicates a trend that businesses, especially those heavily reliant on web usage on PCs such as in the B2B sector, should monitor. Therefore, while Google remains the primary focus for businesses with limited budgets, Bing’s emerging role in the Japanese search engine market shouldn’t be overlooked in strategic planning for SEO and content marketing.

Actual Search Engine Share Across Different Japanese Websites: A Comparative Study

Herein, we present a comparative analysis of organic traffic shares across five different websites that we have helped optimize. The data in this comparison is up-to-date as of July 2023.

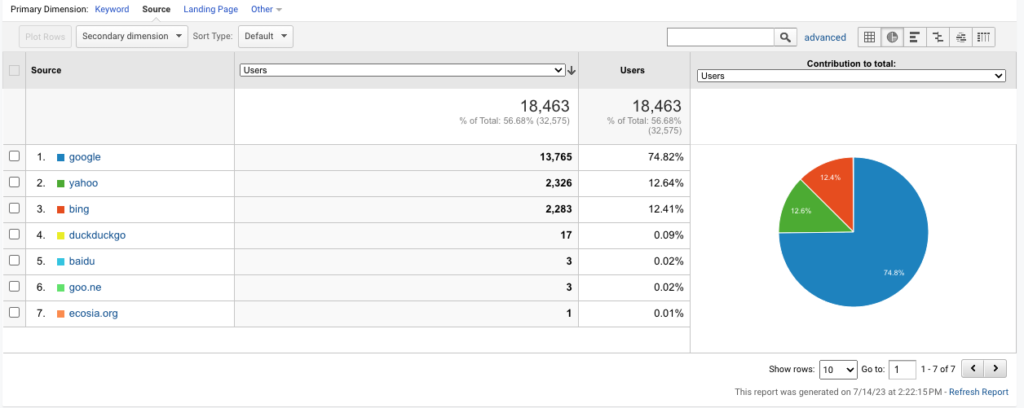

B2B Site (AI-Related)

The following screenshot provides an illustrative analysis of the traffic source, akin to what can be conducted using Google Analytics. The pie chart clearly indicates that Google serves as the prime source of organic traffic for this AI-related B2B company website in Japan, commanding a significant 75% share. Trailing behind are Yahoo and Bing, each accounting for 12% of the traffic, thus underscoring their roughly equal contributions.

B2C Site (E-Commerce)

For the B2C e-commerce site, the attached screenshot reveals that Google’s search engine is responsible for an overwhelming 80% of the traffic, with Bing contributing a lesser 7%. This skewed distribution may be attributed to the B2C nature of this e-commerce site, which garners most of its traffic from mobile devices — a platform where Bing’s presence is markedly reduced.

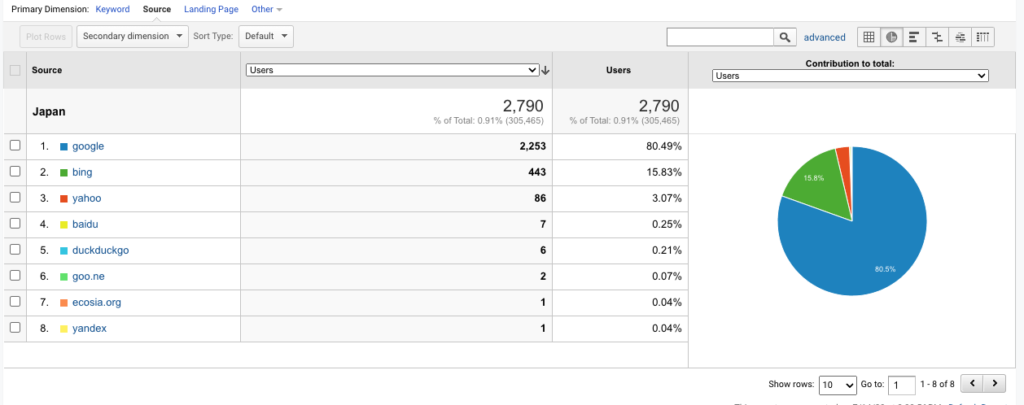

B2B Site (IoT Device)

The subsequent screenshot showcases the search engine traffic share for a B2B IoT device service site. Given the specific nature of its products, this website predominantly attracts domestic manufacturing companies.

Interestingly, while Google still leads with a 67% share, Yahoo has secured 19% — the highest among all examples provided here. This suggests that domestic B2B customers in Japan may exhibit a preference for Yahoo’s search engine.

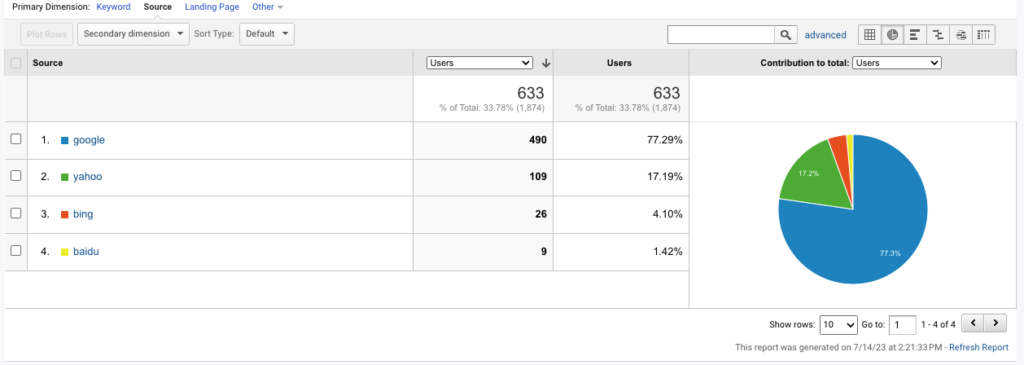

B2B Site (Creative Agency)

This B2B creative agency site registers relatively lower traffic compared to the others. Its prospect profiles are primarily local Japanese companies (specifically, media houses). It is notable that Yahoo serves as the second-largest source of traffic for this site, with Bing contributing a smaller fraction.

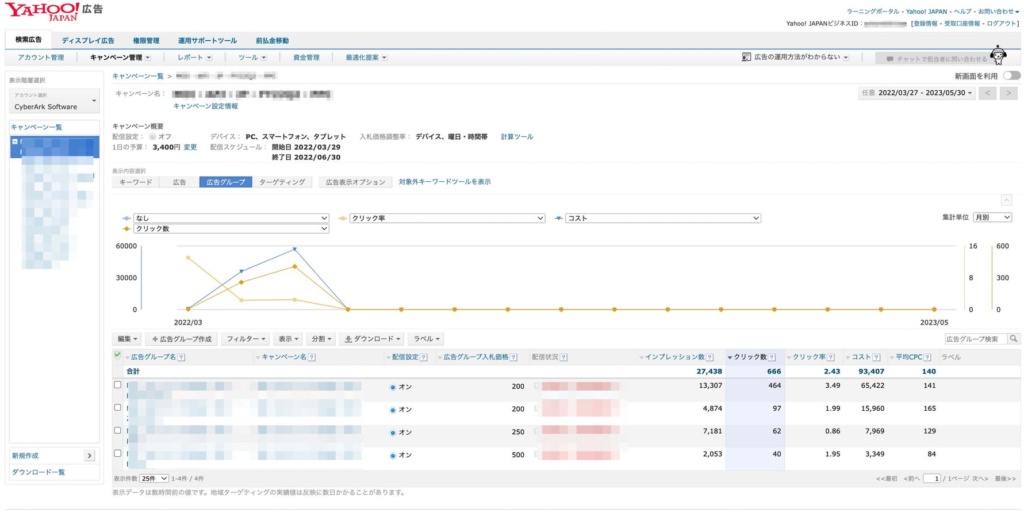

B2B Site (Cyber Security)

The final screenshot shows the organic traffic source distribution for a large international cybersecurity company (data filtered for the Japanese sub-domain only). Here again, Google maintains its dominance with an 80% share. However, the interesting point to note is Bing’s 15% contribution, dwarfing that of Yahoo. One possible explanation could be that users seeking high-tech, international, and innovative products, such as cybersecurity solutions, may predominantly prefer Google.

From the data presented above, it is clear that Google continues to maintain its dominance as the principal source of organic traffic across various websites in Japan. Thus, underlining the validity of the data we’ve shared.

However, it’s worth noting that the actual share of traffic from different search engines, particularly Yahoo and Bing, can vary significantly based on the nature and target audience of your website. Therefore, to maximize visibility and reach, it is essential to optimize your Search Engine Optimization (SEO) strategies or set up advertisements accordingly. This ensures your content reaches the right audience, thus enhancing the effectiveness of your digital presence. It’s evident that a one-size-fits-all approach won’t work, as the search engine usage patterns are quite diverse and distinct among different customer segments. Instead, a more nuanced and tailored approach to SEO and advertising setup is required to ensure success in the ever-evolving digital landscape.

Do Search Volumes Vary Across Different Search Engines in Japan?

Given the substantial differences in usage shares among search engines, it’s natural to expect a corresponding variation in the search volumes across these platforms in Japan.

In the ensuing chart, I have selected a random assortment of keywords and examined their monthly average search volumes on the three major Japanese search engines: Google, Yahoo, and Bing.

| Monthly Average Search Volumes | |||

| Keyword | Google Japan | Yahoo! JAPAN | Bing Japan |

| 転職 (jobs) | 198,000 | 36,000 | 6,680 |

| 保険 (insurance) | 38,000 | 8,600 | 3,050 |

| 腕時計 (watch) | 113,000 | 46,000 | 3,700 |

| クラウド (cloud) | 74,000 | 9,100 | 4,900 |

| サイバーセキュリティ (cyber security) | 7,800 | 400 | 990 |

| 旅行 (travel) | 71,000 | 20,000 | 9,790 |

| 薬 (medicine) | 31,000 | 11,000 | 2,960 |

| IoTデバイス (IoT device) | 1,000 | 100 | 130 |

| ゲーム (game) | 446,000 | 111,000 | 47,880 |

This dataset provides intriguing insights into the monthly average search volumes for selected keywords on the three major Japanese search engines — Google Japan, Yahoo! Japan, and Bing Japan, as of July 2023.

Despite the variations across search engines, it’s important to highlight that Google continues to uphold its dominance across all categories of keywords, further emphasizing its widespread use among Japanese web users.

One of the most notable aspects is the relative prominence of Bing in the context of tech-related search terms. Despite Bing generally recording lower search volumes when compared to Google and Yahoo, it exhibits surprisingly competitive volumes for keywords such as ‘クラウド’ (cloud), ‘サイバーセキュリティ’ (cybersecurity), and ‘IoTデバイス’ (IoT device).

For example, ‘クラウド’ (cloud) sees 4,900 searches on Bing compared to 9,100 on Yahoo, showing that Bing’s search volume is over half of Yahoo’s, despite the latter being generally more popular in Japan. The keyword ‘サイバーセキュリティ’ (cybersecurity) shows a similar trend, with Bing recording almost two and a half times the search volume of Yahoo.

Furthermore, it’s interesting to note that these findings align perfectly with our previous data on actual traffic sources, wherein Bing recorded a higher share for technology-focused websites. This underlines the importance of considering not just the overall popularity of a search engine, but also its relevance to specific industries and fields.

In a broader context, this data underscores the need for marketers to understand their target audience’s search behaviors. Depending on the industry, Bing can play a substantial role in organic traffic, hence underlining the importance of diversifying SEO and Ads (like PPC) strategies and not solely focusing on the dominant Google platform.

Why Does Yahoo! JAPAN Maintain a Relatively Higher Search Engine Share Than in the Rest of the World?

As per the latest StatCounter study, as of July 2023, Google commands a staggering 92.66% share of the global market, dwarfing Yahoo!’s worldwide market share which stands at just 1.09%. Considering that Google’s dominance is nearly universal, it poses an intriguing question: why does Yahoo! maintain a higher share among Japanese users?

The reason behind this phenomenon can be traced back to the origins of internet usage in Japan and Yahoo!’s innovative approach tailored to the local market.

Yahoo!’s Early Entrance in Japan:

Established in 1996, Yahoo! was one of the earliest internet services to launch in Japan, a time when the popularity and usage of computers (and the Internet) were just starting to grow. Its early entry into the market allowed Yahoo! to establish a significant user base before other competitors, like Google, had a chance to make substantial inroads. By the time Google was founded in 1998, Yahoo! had already gained a firm foothold in the Japanese market.

Yahoo! JAPAN’s Unique and Popular Services:

Apart from its early presence, Yahoo! has managed to sustain its popularity in Japan by offering a wide range of services uniquely tailored to the Japanese audience. For example, Yahoo! Chiebukuro is a popular service that offers a platform for users to share and exchange knowledge. This strategic alignment with local needs and tastes has played a pivotal role in cementing Yahoo! JAPAN’s position in the market.

In conclusion, while Google’s global dominance in the search engine market is unchallenged, Yahoo! JAPAN’s strategic positioning, early market entry, and commitment to providing Japan-specific services have helped it maintain a significant share in Japan, setting it apart from the global trend.

Choosing the Right Japanese Search Engine for Your Needs

When it comes to optimizing your online presence in Japan, understanding the landscape of Japanese search engines is crucial. Google Japan and Yahoo! JAPAN dominate the market, accounting for over 90% of search engine usage. Therefore, focusing your SEO efforts on these platforms is a strategic move.

However, it’s important to note that while Google Japan holds the majority share, Yahoo! JAPAN’s unique services and early establishment in the country have earned it a significant user base. Therefore, businesses targeting a Japanese audience should not overlook the potential of Yahoo! JAPAN.

On the other hand, Bing, while holding a smaller market share, can be a valuable platform for businesses targeting a B2B audience, as its usage tends to be higher in this segment.

In conclusion, the right Japanese search engine for your needs will depend on your specific audience and business goals. By understanding the strengths and user demographics of each platform, you can tailor your SEO strategy to effectively reach your target audience in the Japanese market.

Edamame Digital Marketing will also mainly optimization work for Google Japan.

About us and this blog

We are a digital marketing company with a focus on helping our customers achieve great results across several key areas.