Japan E-Commerce | Top 3 Sites, Market Share, and Statistics

The e-commerce market in Japan is expanding year by year. It is an indispensable sales channel when selling any product in Japan.

In such a growing market, it is important to keep track of the current Japanese EC market and its sites and future trends. Therefore, this time we will introduce the features, trends, and countermeasures of the main sites in the domestic EC market.

Japan E-Commerce Market

According to the Ministry of Economy, Trade and Industry’s “Development of Infrastructure for Data-Driven Society in Japan in 2018 (Market Survey on Electronic Commerce)” released on May 16, 2018, the e-commerce market has been expanding steadily.

In 2018, the size of the e-commerce market for consumers in Japan will increase by 8.96% year on year to ¥ 17,984.5 billion. The EC conversion rate, an indicator of the degree of EC penetration, also increased by 0.43 points to 6.22%.

Although the Japanese e-commerce market is said to be lagging compared to other developed countries, it is expected to grow in the future.

Main 3 Japan E-Commerce Sites

If you would like to sell your products online, you would have to cover pretty much the following 3 Japanese e-commerce sites that are used by most Japanese consumers these days.

The three major EC malls in Japan are the following three sites. This time, we will compare the features of each site.

- Amazon Japan(www.amazon.co.jp)

- Rakuten Ichiba (楽天市場)(www.rakuten.co.jp)

- Yahoo! Shopping (Yahoo!ショッピング) (shopping.yahoo.co.jp)

According to a survey on the use of EC sites in Japan released on August 30 by Nielsen Digital, a viewing behavior analysis service, the number of users of Amazon and Rakuten Ichiba in June 2018 (view-only, Including users) were both about 40 million.

The number of online shopping service users was 40.79 million for Amazon, 40.28 million for Rakuten Ichiba, and 26.45 million for Yahoo! Shopping.

The reach rate, which calculates the number of users based on the population of Japan between the ages of 18 and 64, is 56% for Amazon and Rakuten Ichiba, and 37% for Yahoo! Shopping.

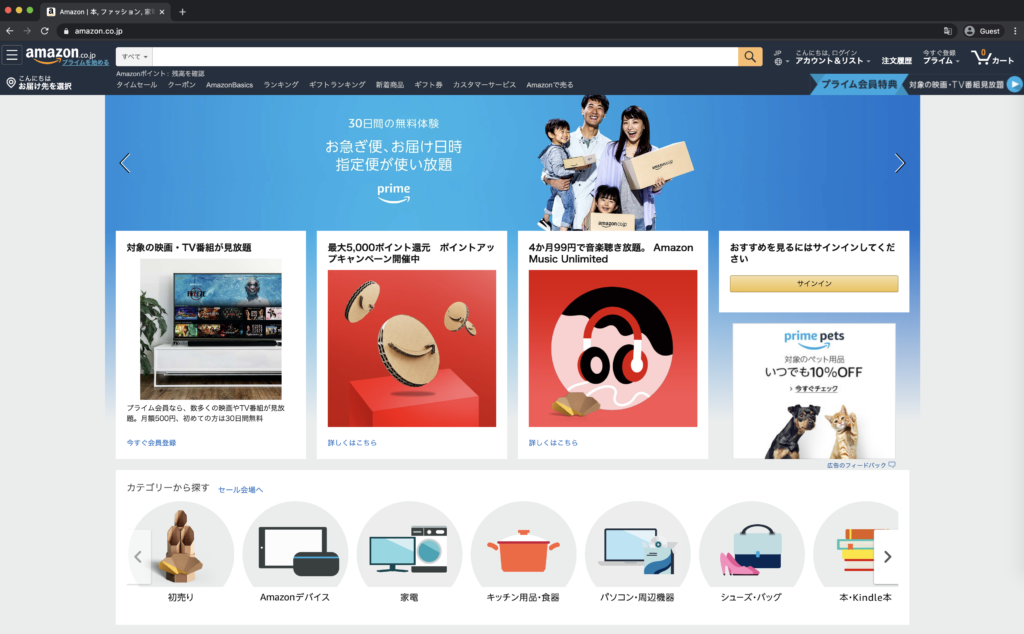

Amazon Japan: The Biggest in Japan E-Commerce

Amazon is dominant in Japan as well.

There are large-lot and small-lot listings, but large-scale listings are better if you operate an EC site in scale. Unlike other e-commerce sites, you can start selling immediately after applying.

The sales royalties are slightly higher, but do they include the payment fee and the fact that they do not need to deal with sales promotions or pages compared to other malls?

Initial fee

- free

Monthly Fee (excluding tax)

- Large exhibition 4900 yen

- Small exhibition 0 yen

System commission / Sales commission

- Sales commission: 8-20% (depending on product category)

- * 45% of Kindle accessories

- * For media products, category closing fee of 30 yen or more is required separately

- * For small lots, a basic contract fee of 100 yen/item is required separately

Product pages and product images that conform to the planned format cannot stand out interest in page design. In other words, this is a tendency to fall into price competition.

In particular, products that are handled by Amazon will be price competitive, so it is necessary to make adjustments such as adjusting the exhibition while checking the inventory status in Amazon.

Rakuten Ichiba: Various Campaigns Japan E-Commerce

The shopping mall boasts an overwhelming ability to draw customers, with a total domestic sales of 2.5 trillion yen, an average monthly sales of 4.16 million yen per store, and 3.4 billion page views.

There are a lot of campaigns for store support, and the products and prices go well, so that big sale can be expected from the first month.

Initial fee

- 60000 yen

Monthly Fee (excluding tax)

- Light plan 39,800 yen (for 3 months)

- Go for it! Plan 19500 yen (all at once)

- Standard plan 50,000 yen (divided twice every six months)

- Mega Shop Plan 100000 yen (divided twice every six months)

System commission / Sales commission

- Light plan 3.5-5.5%

- Go for it! Plan 3.5-7.0%

- Standard plan 2.0-4.5%

- Mega Shop Plan 2.0-4.5%

A mall that cannot be avoided if you really want to compete on the EC site. In order not to get involved in price competition, it is necessary to increase the brand value of the company’s website and SNS and create a flow that leads to stores from outside. By the way, links from Rakuten stores to the outside are prohibited.

Yahoo! Shopping: Free Japan E-Commerce

The number of stores has increased dramatically since 2013 when it became completely free, and it is now the largest store in Japan.

There are “Light Store” for beginners who can easily create a store from a smartphone in 3 steps, and “Professional Store” for those who want to build and operate a store in scale.

Initial fee

- free

Monthly fee (excluding tax)

- free

System commission / Sales commission

- free

The good news is that you can use all the functions for free, you can expect to attract customers from the portal site Yahoo !, you can use external links for free (with notice), and you can use the customer list for secondary use. However, the impression that supports each store is slightly weaker, probably because of the rapid increase in the number of stores.

In summary, we recommend using at least Amazon Japan and Rakuten Ichiba if you are thinking to start selling products in Japan. Yahoo! Japan is free and no cost, but it is very difficult to stand out in many products without well-known products and also, even there is no cost there is always opportunity cost of optimizing Amazon or Rakuten.

The mobile trend in Japanese e-commerce

In 2018, the market size of BtoC-EC via smartphones in the product sales field increased by ¥ 646.2 billion to ¥ 3,065.2 billion (up 21.5%). This is equivalent to 39.3% of the size of the B2C-EC product market of ¥ 9,299.2 billion.

In the past, smartphones had disadvantages such as the difficulty in character input and the inconsistent communication environment compared to personal computers, and there were high barriers to smartphone sales for users.

However, with the evolution of smartphones and communication environments and the spread of large-screen smartphones of 5 inches or more that are easy to input, users have become more and more used to purchasing products on smartphones, and it has become commonplace to purchase on smartphones.

Credit card payments have become more widespread due to the spread of mobile phones since 2000, and resistance to entering credit card numbers on smartphones has been a major factor in the expansion of the market scale via smartphones.

As a result, the e-commerce market via smartphones has reached about 40% of the total, and product sales via smartphones should continue to spread widely.

Payment methods in Japanese e-commerce

As for payment methods on the Internet in Japan, “credit card payment” overwhelmingly increased the usage rate from last year to 66.1%, but ranked first, such as “convenience store payment” and “cash on delivery”, which are second or less We have reduced the usage rate for all but.

However, in a survey of SB Payment Service, a subsidiary of SoftBank, when asked about the payment method most used on merchandise sites by age, the usage rate of credit card payments in their teens and twenties was low, with 52.4% of men in their teens use other than credit card payments.

Among credit card payment methods for teenagers on the merchandise website, “credit card payment” was the highest at 47.6%. Below, 21.4% of convenience store payments, 9.5% of carrier payments, and 7.1% of cash on delivery. 56.7% of teenage women on a product sales site said “Credit card payment”.

According to the comments of users who use “convenience store payment”, there was a reply that they did not have a “credit card” in the first place. For e-commerce sites targeting younger users, it seems likely that they will need to provide a means of payment other than credit card payment.

Summary

The following summarizes trends and measures in the Japanese EC market, where growth is expected. Please make use of it to improve the e-commerce market, which has been performing well in the Japanese economy.

It also introduced three major e-commerce sites used in Japan and their simple features.

If you are interested in entering the EC, please contact us here.

About us and this blog

We are a digital marketing company with a focus on helping our customers achieve great results across several key areas.